Chief investment officer Kelsey Deshler discusses how the Investment Office grows the endowment’s value.

How does the investment team manage Carleton’s endowment?

Oversight is provided by the Board of Trustees’ Investment Committee, which helps develop the endowment’s overall investment strategy and monitors its performance. Day-to-day management of the portfolio is done by the Investment Office: a team of four seasoned investment professionals and one or two Carleton students. They conduct in-depth due diligence on investment strategies across a variety of asset classes, including public and private equity, marketable alternatives, and real assets.

Do Carleton’s investments change?

Yes, we will modify the portfolio as opportunities emerge. That said, we have a long-term perspective, and any new investment is expected to add value for years to come.

The Investment Office and the Investment Committee work together to strike the appropriate balance between generating income for the college’s needs today and preserving capital for the benefit of future generations.

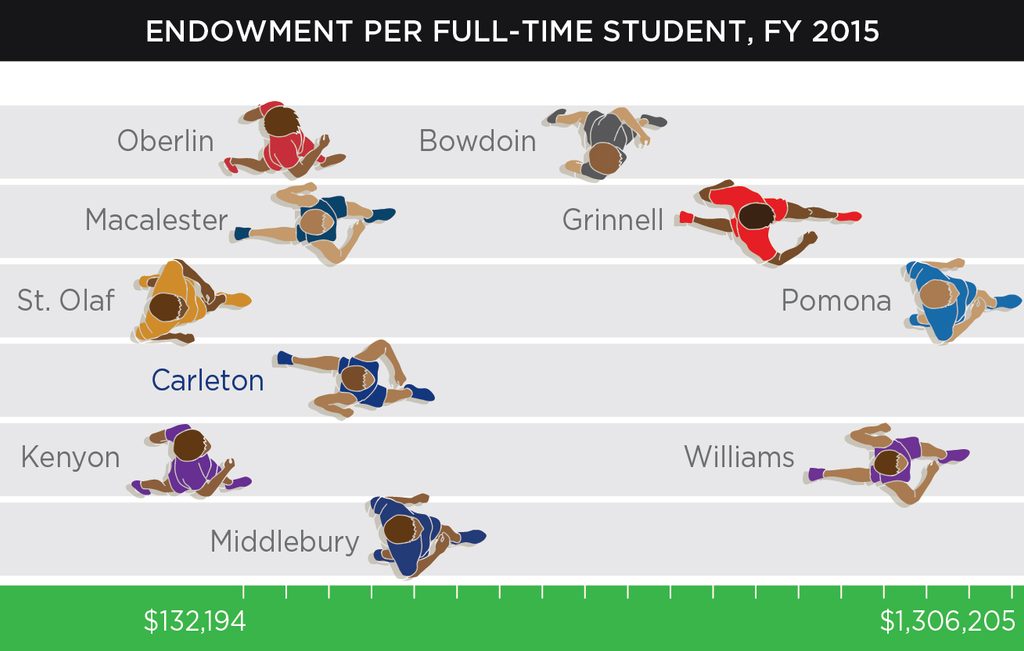

How does Carleton’s endowment compare to that of its peers?

No two endowments are identical. Carleton’s endowment supports approximately 26 percent of the college’s operating budget, and our objective is to generate an approximate 7 percent nominal return. As a result, we tend to have a moderately less aggressive risk profile than our peers. Further, we have generally been cautious navigating the current market environment as asset prices and valuations are at historic highs across many investment categories, and consequently, we are managing the endowment more conservatively than we would if asset prices were lower.

Overall, though, I would say the endowment’s medium- and long-term track record compares well to that of our peers and has exceeded our objectives, in both absolute and risk-adjusted terms.